Net present value of annuity

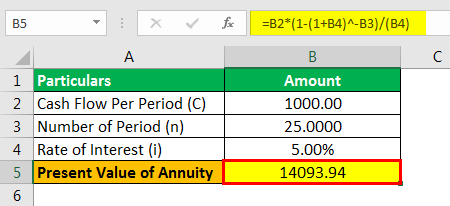

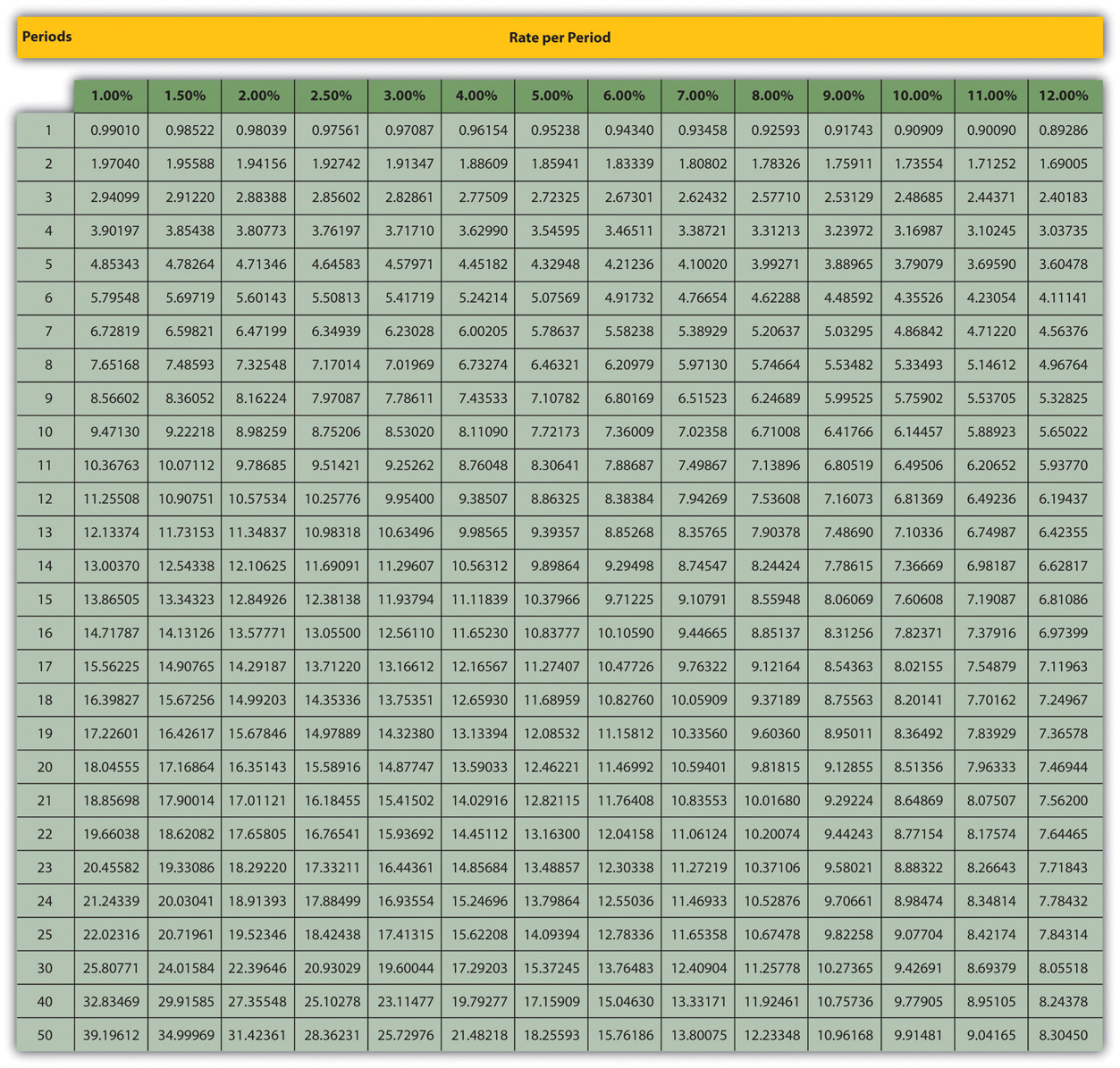

The net impact of these two forces will determine if your future value rises or falls relative to the present value today. By looking at a present value annuity factor table the annuity factor for 5 years and 5 rate is 43295.

Present Value Of An Annuity Definition Interpretation

Net present value NPV is the present value of all future cash flows of a project.

. Net present value NPV lets you know whether the value of all cash flows that a project generates will exceed the cost of starting that particular project. Thus this present value of an annuity calculator calculates todays value of a future cash flow. Present value of an annuity is finance jargon meaning present value with a cash flow.

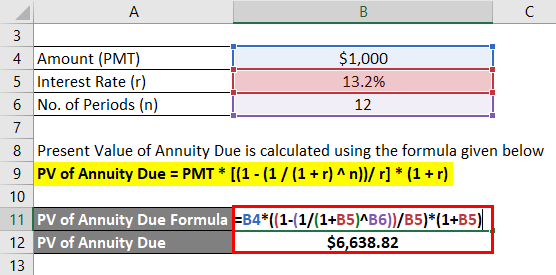

PV of Annuity Due 500 1 1 1 1212 12 1 12 PV of Annuity Due Explanation. It means if the amount of 3415 is invested today 10 per year compounded annually it will grow to 5000 in 4 years. 5000 it is better for Company Z to take Rs.

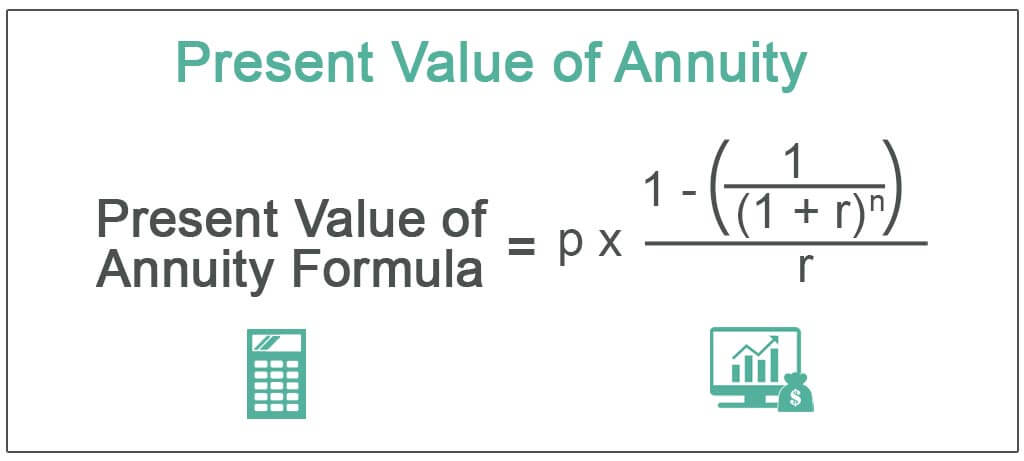

The cash flow may be an investment payment or savings cash flow or it may be an income cash flow. The present value is simply the value of your money today. Annuity formulas and derivations for present value based on PV PMTi 1-11in1iT including continuous compounding.

These are often the equivalent time period of months or years but a period can be. With an annuity due payments are made at. NPV Present value of Inflows Present value of outflows.

Step 4 To arrive at the PV of the perpetuity divide the cash flows with the resulting value determined in step 3. Future cash flows are discounted at the discount. Annuity Due Payment - Future Value FV Calculator.

Annuity Payment - Future Value FV Calculator. Explanation of PV Factor Formula. Calculating the present value of an annuity due is basically discounting of future cash flows to the present date in order to calculate the lump sum amount of today.

The idea behind present value is that money you receive today is worth more than the same amount of money if you were to receive it in the future. The present value PV is what the cash flow is worth today. Type - 0 payment at end of period regular annuity.

Annuity Due Payment - Present Value PV Calculator. By putting the values of n and i into the present value of a single sum formula. Calculate the present value of an annuity due ordinary annuity growing annuities and annuities in perpetuity with optional compounding and payment frequency.

Basically it will tell you whether your project has a positive or a negative outlook. Rate Per Period As with any financial formula that involves a rate it is important to make sure that the rate is consistent with the other variables in the formula. This is the present value per dollar received per year for 5 years at 5.

An annuity is a series of equal payments or receipts that occur at evenly spaced intervals. PV FV 11 i n. Present Value - PV.

If you kept that same 1000 in your wallet earning no. To calculate the PV of the perpetuity having discount rate and growth rate the following steps should be. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at a certain rate.

Like an ordinary annuity Periods This is the frequency of the corresponding cash flow. As present value of Rs. For example if you receive 5000 now in one lump sum it has more value than receiving 1000 a year for the next 5 years.

Compound Interest Formula Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. The inputs to PV are as follows.

Nper - the value from cell C8 25. The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date. If you have 1000 in the bank today then the present value is 1000.

For example an individual is wanting to calculate the present value of a series of 500 annual payments for 5 years based on a 5 rate. 5500 after two years is lower than Rs. Calculate the net present value of uneven or even cash flows.

The difference between the present value of cash inflows and the present value of cash outflows. Rate - the value from cell C7 7. Step 3 Next determine the discount rate.

Because the time-value of money dictates that money is worth more now than it is in the future the value of a project is not simply the sum of all future cash flows. Loan rental payment regular deposit to saving. Pmt - the value from cell C6 100000.

How to Figure Out the Present Value of a Future Sum of Money. Finds the present value PV of future cash flows that start at the end or beginning of the first period. The amount of 5000 to be received after four years has a present value of 3415.

Present value means todays value of the cash flow to be received at a future point of time and present value factor formula is a toolformula to calculate a present value of future cash flow. A popular concept in finance is the idea of net present value more commonly known as NPV.

Present Value Of Annuity Formula Calculate Pv Of An Annuity

What Is An Annuity Table And How Do You Use One

Present Value Of An Annuity How To Calculate Examples

Present Value Pv Of An Ordinary Annuity Formula With Examples Time Value Of Money Youtube

Present Value Of An Annuity How To Calculate Examples

Appendix Present Value Tables Financial Accounting

How To Calculate The Present Value Of An Annuity Youtube

Present Value Of Annuity Due Formula Calculator With Excel Template

1 Present Value Annuity Formula Download Scientific Diagram

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Annuity Present Value Pv Formula And Excel Calculator

Excel Formula Present Value Of Annuity Exceljet

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Of Annuity Formula With Calculator

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Annuity Present Value Pv Formula And Excel Calculator

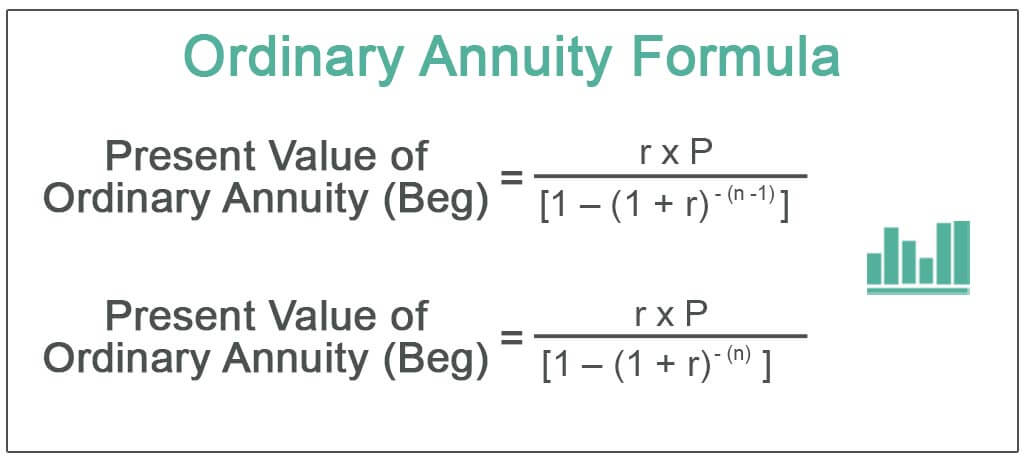

Ordinary Annuity Formula Step By Step Calculation